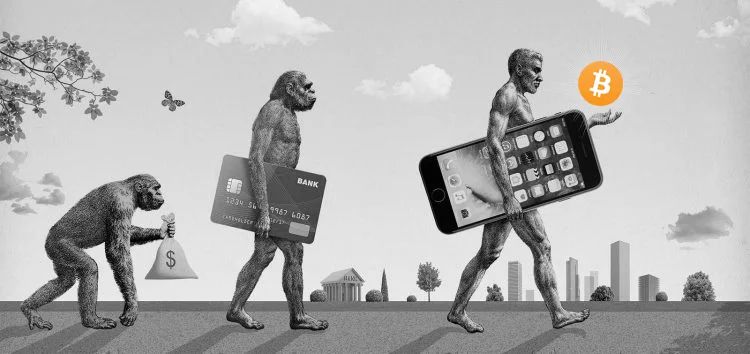

By creating an entirely new payment system based on decentralized blockchain technology, Bitcoin has changed the financial sector. Bypassing banks and their own corporate systems, this made it feasible to provide customers with financial services that were more affordable without arduous and complicated procedures. Let’s examine why Bitcoin will replace other digital currencies in the future and what aspects of it make it possible.

An alternative to the current financial system is the digital future

Prior to figuring out why Bitcoin will be the mainstay of cashless transactions, it is important to emphasize the key characteristics of upcoming digital currencies and ascertain what they will be like. Cash payments are being rejected by banks and more consumers, especially in light of the epidemic. Infections and viruses can spread through the usage of currency, which also carries a variety of diseases. These drawbacks do not apply to cashless payment systems. This calls for the support of cashless transactions, even offline ones, in current digital networks.

Major analysts and businesspeople share this viewpoint. For instance, Twitter CEO Jack Dorsey has stated that Bitcoin should be the Internet’s official currency. He believes that in order for individuals to use cryptocurrency for their requirements, online platforms must be modified.

As another quote from Dorsey put it, “Blockchain and Bitcoin define the future – a world where content exists forever.”

This is consistent with one of Bitcoin’s fundamental characteristics, which is that it can exist indefinitely. A single Issuer cannot wipe off the blockchain. The goal is to establish a trust system in the Internet, which is essentially an untrustworthy environment. Future currencies should possess these characteristics.

Decentralization

Central banks control exchange rates. The issue of fiat money is also under their control. In other words, the government holds a concentrated amount of power over the money system, which limits user freedom. Naturally, banks want to create a Central Bank Digital Currency (CBDC) to streamline their processes and develop them. But the center will be the same.

Rapid transfers and payments

Your payment is quick when you make purchases. But many of you have no idea what a complex network the money goes through then: acquiring, paying charges to bankers, payments to companions, and so on. This is a complicated process that requires a lot of money, which increases the price, and this adds up to the overall cost of goods and services. Customers actually pay for all this themselves, so institutions and other companies do not charge fees for paying at the checkout.

Purchase processing also takes a lot of time and can take days for the bank to process the request. You can complete transactions more quickly thanks to blockchain, and the fees may be lower, which may reduce the cost of goods and services. However, this holds true for payments as well as payments.

Transactions are typically completed immediately and without charge when you transfer money from one card to another. But when it comes to exchanges from account to account, cross – border payments and global exchanges, the situation is different. Before the move is received by the recipient, the income must go through a complete administrative network in the bank, which uses up a lot of sources. All purchases are verified, accompanied by massive evidence and must be confirmed by the bank’s staff. Therefore, lenders charge a big fee, and the exchange itself can take up to 3 times. But what to do if you need the funds immediately?

Mobility

The cash of the future should be smart: immediate payments, fast conversion, lower fees, and so on. With the rapid pace of life in the modern world, it is important that services are provided as quickly as possible. In order to open a bank account, you must provide your personal data (which, by the way, can easily be stolen and compromised), go to the bank’s office or meet with the manager in person. In any case, this is a long and unwanted procedure. Unwanted for customers, but necessary for legitimate companies and governments.

Additionally, you must re-do everything and open new accounts if you need to exchange money, available a deposit, or borrow money. All this takes time, and it is paid for by the clients themselves, who pay for all this job, although they don’t need it.

Electronic currencies of the future should be free of these drawbacks. If you want to start a Bitcoin accounts, you just need to install and produce a cryptocurrency budget, and this is done in five minutes or less.

You can easily connect your wallet to a decentralized crypto exchange (DEX) and complete the exchange if you want to trade one digital asset for another. And if you need to use bitcoin, it can be easily done with the help of decentralized crypto lending programs, such as Maker or Compound. In contrast, interest rates there are much lower than in traditional institutions.

You can even easily open a deposit via services such as Nexo or Crypto.com, and receive from 6 % to 12 % per annum just for holding cryptocurrency. Interest rates on the Maker and Compound systems are lower than payment rates, which actually allows you to receive interest on loans, but you will require collateral. You can start a payment right away if you have already made an investment in Bitcoin. In any case, you must purchase Bitcoin or another cryptocurrency in order to access quite straightforward and lucrative services.

Bottom line

Bitcoin will be the potential of online cashless payments, despite its drawbacks. The value of property and the capacity to be used in payments are combined in cryptocurrencies. Stocks won’t be able to be used to pay in stores, and currencies have no particular investment value. None of the current currencies have the freedom, functionality, speed, or decentralization that Bitcoin embodies in the future of digital currencies.